Commercial Tenants: Covid resources: Help with Rent, Utilities and Payroll

Nov. 2020 Covid Grant for Massachusetts: up to $25,000 for under 5 employees and up to $75,00 for under 50 employees

Timeline: Application will be open for 3 weeks

10/22/2020 at 12:00 PM – Application opens.

11/12/2020 at 12:00 PM – Application closes.

APPROVED USE OF FUNDS:

Funds may be used for working capital to cover business costs, such as rent, staffing, utilities, and technical assistance, general support and stabilization of the business. Funds may also be used for purchasing personal protection equipment (PPE).

Small Business Strong: Programs and Support Services

Resources to help all Small Businesses access capital, navigate reopening and support employees

A letter from our accountants:3.27.20

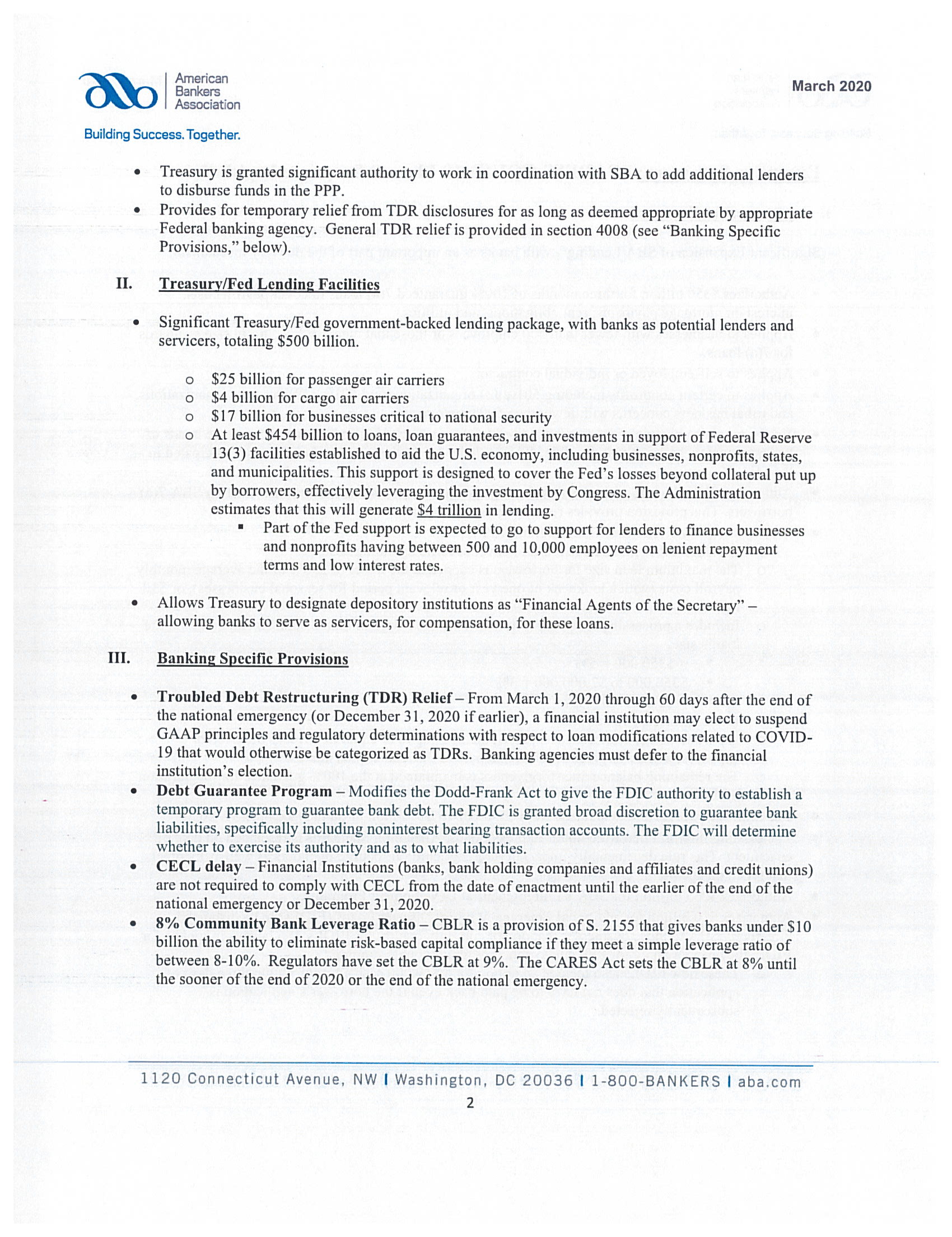

- Employee Retention Credit – credit against employment taxes equal to 50% of qualified wages paid to employees who are not working due to the partial or complete close of business or a significant decline in gross receipts. This is limited to $10,000 per employee for all quarters. Applies to wages paid after March 12, 2020 until January 1, 2021. Discuss this with your payroll provider as they will be working with this directly.

- Payroll Tax Deferral – deferral of your payroll taxes that are due. Half due December 31, 2021, and the remainder due December 31, 2022.

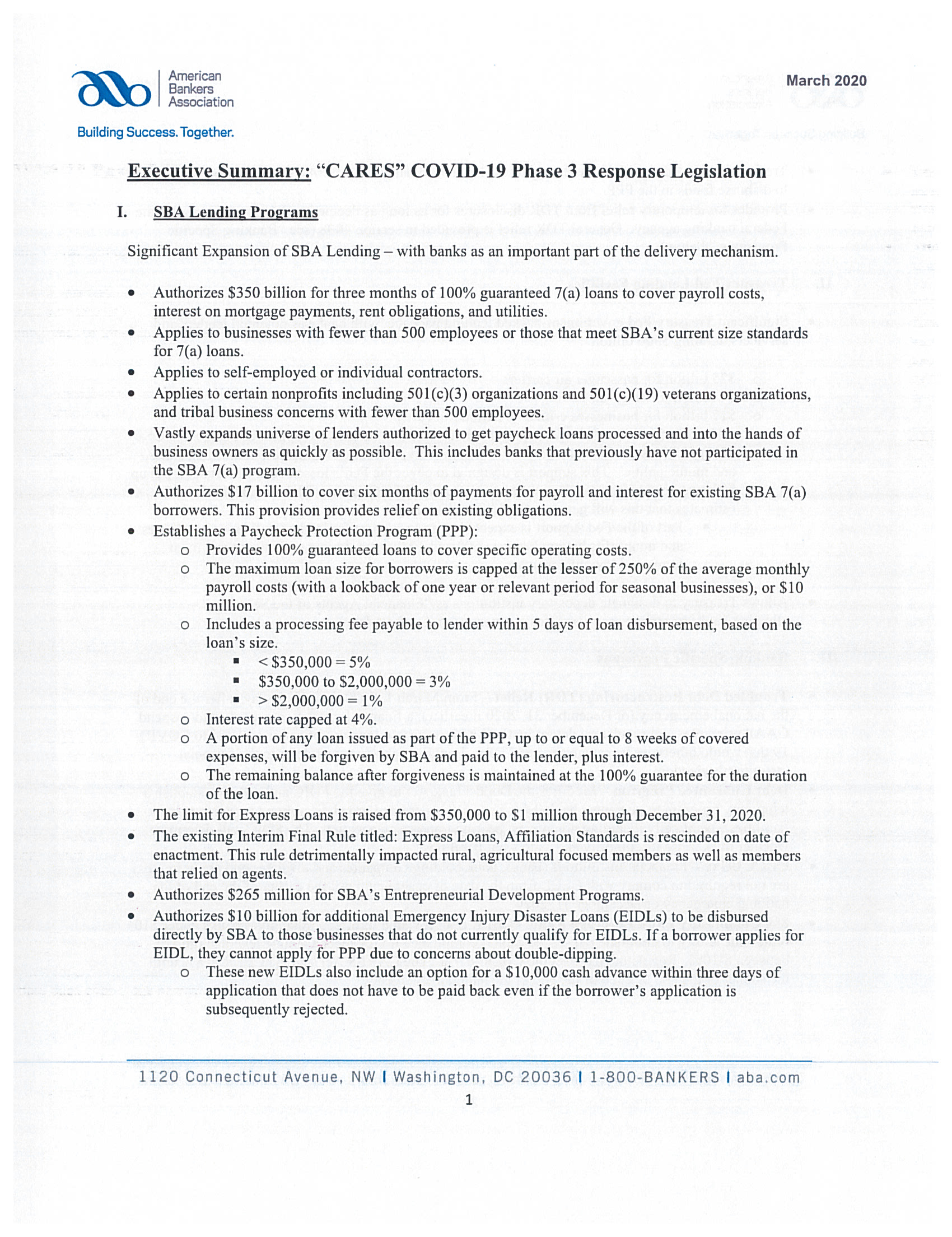

- Small Business Loans - $350 billion in ‘Paycheck Protection Loans’ loans under Section 7 of the SBA have been made available during the “covered period” of February 15, 2020 – June 30, 2020. These are available through December 31, 2020 and are based on a formula of your average monthly payroll costs for a 1 year period. The loans would be used to cover payroll, mortgage payments, rent, utilities and any other debt service requirements.

- Payroll costs include the following:

- Wages, commissions, salary, or similar compensation to an employee or independent contractor,

- Payment of a cash tip or equivalent,

- Payment for vacation, parental, family, medical or sick leave,

- Allowance for dismissal or separation,

- Payment for group health care benefits, including premiums,

- Payment of any retirement benefits, and

- Payment of state or local tax assessed on the compensation of employees

- Loan Forgiveness of Paycheck Protection Loans – a portion of those loans mentioned above would be forgiven on a tax-free basis (not included in your income). The amount forgiven in the sum of the following payments made by the borrower during the 8 week period beginning on the date of the loan:

- Payroll costs

- Mortgage interest

- Rent

- Certain utility payments

- Any forgiveness would have to be documented and submitted to the lender.

There are also a few other SBA loans available but the one above seems like the most economical for everyone right now. It also looks like these will be accessible through banks that already work with the SBA so please contact your existing banking relationship if you have one.

Here are some links for your reference:

https://springfieldregionalchamber.com/covid-19-resources/

https://www.sba.gov/funding-programs/disaster-assistance

Also as a side note – the state of Massachusetts has NOT extended the filing deadline to conform with the federal government deadline of July 15th. As of today, the date to file Massachusetts tax returns is still April 15, 2020.

Application for Loan Forgiveness and Your PPP Loan With bankESB

To help you better understand and comply with the rules and requirements of your Paycheck Protection Program (PPP) loan, we are sharing new and updated advisories from the Small Business Administration (SBA) and other resources below and on our Small Business COVID-19 Resource Center webpage. Please continue to watch for important updates.

SBA PPP Loan Forgiveness Application Now Available

On May 15th, the SBA released its Paycheck Protection Program Loan Forgiveness Application (SBA Form 3508) that borrowers must complete to receive full or partial forgiveness for loans issued under the Paycheck Protection Program. Please click on the link above to begin to familiarize yourself with the information that will be required for seeking forgiveness when your eight-week covered period ends.

The SBA plans to issue additional guidance regarding PPP loan forgiveness. These updates may result in changes to the loan forgiveness application, instructions, and process. Also, recent news accounts have indicated that the SBA and Congress are considering changes to the program to provide additional flexibility to borrowers. We will update you once we hear more from the SBA.

Updated SBA PPP Loan Frequently Asked Questions (FAQs)

On May 19th, the SBA updated the Frequently Asked Questions publication we shared in our last email. Access to the full, updated version is available by clicking on the link above. Please review this guidance and look for future updates.

Emergency Paid Sick Leave Act

All businesses* with less than 500 employees:

- Required to pay sick leave at regular rate of pay for 2 weeks (80 hours) for FT and PT employees (formula to figure out how many hours to base pay for PT employees) if employee is sick, seeking treatment, or required by federal, state, or local order or been advised by health care provider to self-quarantine (Qualifying for this relief is a good reason for our cities to mandate lockdown)

- Employer gets 100% of employee’s regular rate not to exceed $551/day or $5110 in total 941 tax credits for reasons above

- Additional 941 tax credits for health insurance coverage costs (no specifics yet)

- Required to pay sick leave at 2/3 rate of pay for 2 weeks (80 hours) for FT and PT employees (formula to figure out how many hours to base pay for PT employees) if employee is caring for someone who is sick or subject to quarantine by federal, state, or local order, caring for child under 18 whose school or day care has closed or some “substantially similar condition” (TBD what that means)

- Employer gets 2/3 of employee’s regular rate not to exceed $200/day or $2,000 in total 941 tax credits for reasons above

- Additional 941 tax credits for health insurance coverage costs (no specifics yet)

- All eligible employees may use paid sick time beginning on April 2 (seems kind of late). Employers may not require employees to first use other paid leave provided by employer before sick leave under the act so this is in addition to paid sick leave or PTO currently provided by employers.

- Required to have poster information about employee rights and Labor Dept should have something available for employers by March 25.

* Businesses with 49 or fewer employees may be exempt from required paid leave if it proves detrimental to operations.

Expansion of FMLA/Paid Family Leave

All businesses* with less than 500 employees:

- Required to pay family leave at 2/3 rate of pay for 10 weeks for FT and PT employees (formula to figure out how many hours to base pay for PT employees) if employee is caring for child under 18 whose school or day care has closed (Note: 12 weeks total covered under FMLA for permissible leave and job restoration, tax credits segregated between first 2 weeks and subsequent 10 weeks.)

- Employer gets 2/3 of employee’s regular rate not to exceed $200/day or $10,000 in total 941 tax credits for reasons above

- Additional 941 tax credits for health insurance coverage costs (no specifics yet)

* Businesses with 49 or fewer employees may be exempt from required paid leave if it proves detrimental to operations

Tax credit against self-employment tax

Eligible self-employed individual shall be allowed a credit against the self-employment tax if they would be entitled to receive paid leave during the taxable year pursuant to this Act if the individual were an employee of another employer.

- Self-employed individual gets 100% for sick leave (same criteria as noted above) of average daily S/E income* not to exceed $551/day or $5110

- Self-employed individual gets 2/3 for family leave (same criteria as noted above) of average daily S/E income not to exceed $200/day or $2,000 for first 2 weeks.

- Self-employed individual gets 2/3 for family leave (same criteria as noted above) of average daily S/E income not to exceed $200/day or $10,000 for subsequent 10 weeks.

Below is a direct link to the treasury departments summary as well

https://home.treasury.gov/news/press-releases/sm952

Credit Card Relief Programs:

Amherst Area Chamber of Commerce:

https://www.amherstarea.com/covid-19

Northampton Chamber of Commerce:

https://www.northamptonchamber.com/coronavirus-covid-19-response/

Small Business Credit Cards:

https://www.sba.com/funding-a-business/business-credit-cards/

SBA Loans:

https://disasterloan.sba.gov/ela/

Common Capital: (Small business loans)

https://www.common-capital.org/

In light of the UMASS campus (dining facilities) being closed and students returning to the area; this could be a great opportunity to boost your takeout and delivery services. (Please see some delivery service company options below) If you would like us to help you advertise, please send us some marketing material.

3/23/20 Governor closes non-essential businesses but encourages restaurants to continue take-out. https://www.mass.gov/doc/covid-19-essential-services/downloadfbclid=IwAR0qXatKvCd6ZRZiNbyV07Gf54bJ2RBgThG1XQODfvcm3yUa3i7IQ_Li9fA

“Restaurants, bars, and other establishments that sell food and beverage products to the public are encouraged to continue to offer food for take-out and by delivery if they follow the social distancing protocols set forth in Department of Public Health guidance continue operations. On-premises consumption of food or drink is prohibited.”

DoorDash:

Delivery express:

https://amherst.deliveryexpress.com/

GrubHub:

Tax Relief:

https://www.irs.gov/coronavirus

Paid Leave and Tax Credits for Small Businesses

Congressman McGovern’s office:

https://mcgovern.house.gov/helping-you/covid19.htm

Restaurant Strong Fund- to support restaurant employees

https://www.thegreghillfoundation.org/restaurantstrong/

Residential Tenants:

Student loan assistance:

https://myfedloan.org/borrowers/covid/

Credit Card Assistance

Personal loan and banking assistance:

https://www.debt.org/2020/03/16/coronavirus-relief/

Online Yoga classes:

http://www.yogacenteramherst.com/online/

Online Pilates Classes:

https://thepilatesstudioinhadley.com/announcement-tele-classes-membership-details/

Amherst: Open for Business link to restaurants and retailers:

https://docs.google.com/document/d/1MSBFnv08nc7yap2TmBgmyLyUfzEwLixoc1updNS8jxU/edit

A letter from our accountants:3.27.20

So far for individuals it’s looking like checks will be distributed to families beginning in a few weeks.

- $1,200 single/$2,400 married PLUS $500 for each child under 17

- Income limits are $75,000 single/$150,000 married. Once over those threshold, you’ll lose $5 of your payment for every $100 over those thresholds. Completely phased out over $99,000 single/$198,000 married. Although after reading various things, depending on kids, you could still receive something if you are over those amount

- The income is based on your Adjusted Gross Income – Line 8b on your Federal Form 1040 from 2019 if you have already filed, or 2018 if you have not.

- If your income is over those amounts for 2020, there does not seem to be anything about repaying any excess.

“The SBA loans strike a balance between loans on favorable terms and grants by providing forgiveness to firms that use loaned funds for payroll, rent, mortgage interest, and utility payments,”

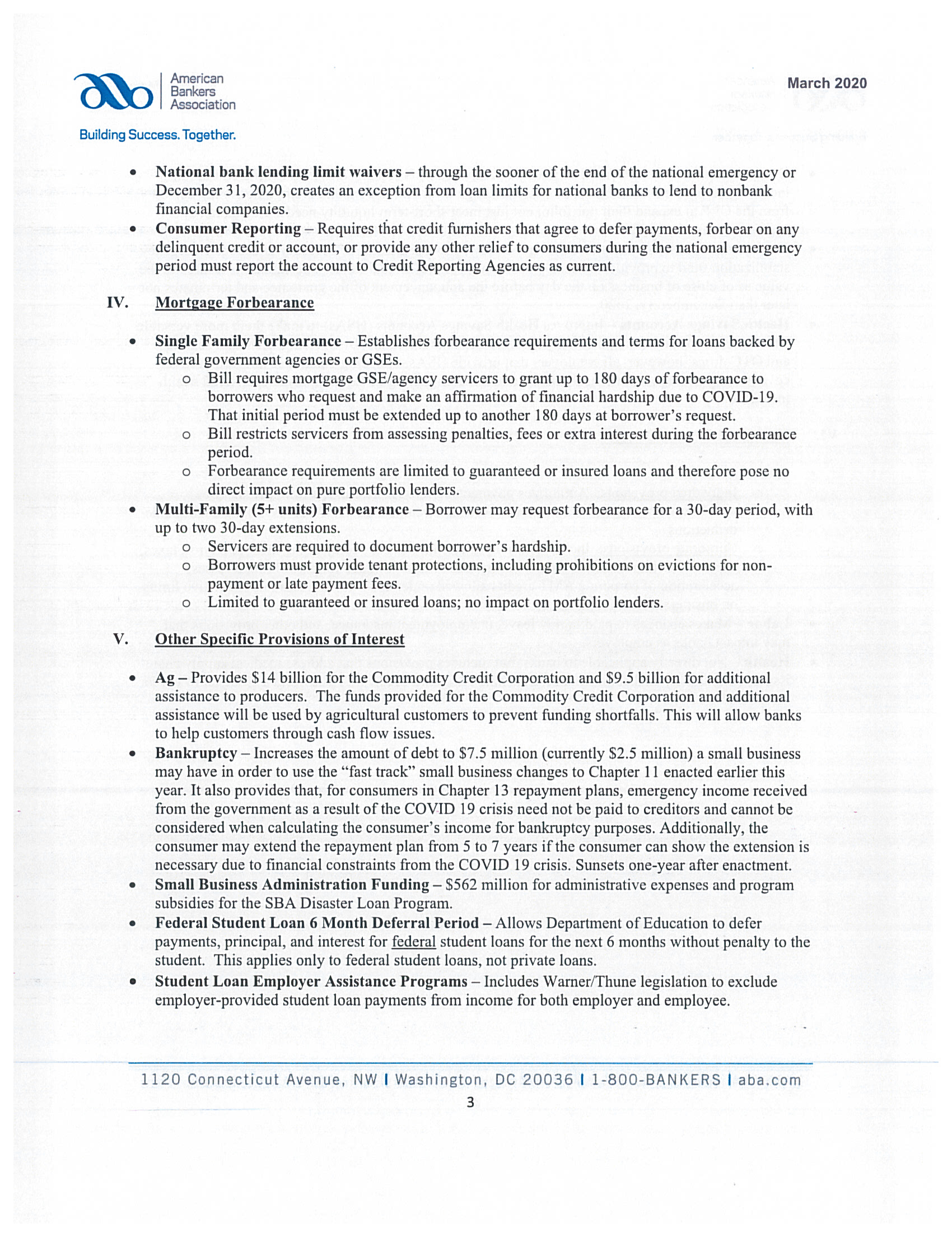

Coronavirus (COVID-19) Assistance- SBA

If you are inquiring about Coronavirus (COVID-19) assistance, the U.S. Small Business Administration is offering low-interest federal disaster loans for working capital to small businesses in designated areas suffering substantial economic injury as a result of the Coronavirus (COVID-19).

As of March 21, 2020, small businesses located in all 50 states, the District of Columbia, and the U.S. territories of American Samoa, Guam, Northern Mariana Islands, Puerto Rico, and the Virgin Islands are now eligible to apply for SBA Disaster Assistance.

If your business was economically impacted by Coronavirus (COVID-19) you may apply online at https://disasterloan.sba.gov/ela. If you are unable to apply online, you may download an application at https://disasterloan.sba.gov/ela, under the Loan Information tab.

Completed applications should be mailed to:

U.S. Small Business Administration

Processing and Disbursement Center

14925 Kingsport Road

Fort Worth, TX 76155

To find the latest information related to the Coronavirus please continue to check our website at sba.gov/disaster.

Additional information about our Economic Injury Disaster Loans:

• SBA’s Economic Injury Disaster Loans offer up to $2 million for working capital to help support small businesses overcome the temporary loss of revenue they are experiencing.

• These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. The interest rate is 3.75% for small businesses and 2.75% for non-profits.

• SBA offers long-term loans up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

• SBA’s Economic Injury Disaster Loans are just one piece of the expanded focus of the federal government’s coordinated response, and the SBA is strongly committed to providing the most effective and customer-focused response possible.

If you have any additional questions, please feel free to reach back out to us via email, or call our Customer Service Center at (800) 659-2955. Individuals who are deaf or hard‑of‑hearing may call (800) 877-8339.

Thank you in advance for your patience,

SBA’s Disaster Assistance Customer Service Center

Coaching sessions

Jena Schwartz (17 Kellogg Ave. Amherst) is offering pay-what-you-can coaching sessions, which anyone can use to have a kind, supportive space to process what’s happening. To get in touch with her, please visit her website: www.jenaschwartz.com/contact. In addition, membership to her online Truth + Beauty Club is currently also pay-what-you-can, and offers folks a place to write our way through this unprecendented time. Details here: www.jenaschwartz.com/tbc

Thank you for reaching out to the U.S. Small Business Administration Disaster Assistance Customer Service Center. We are currently experiencing a high number of phone calls and e-mails, so we hope this information answers your question.